The Middle East and North Africa region—commonly referred to as MENA—possesses a remarkable blend of human capital and natural wealth. It holds a substantial share of global petroleum reserves and plays a key role in international energy markets. Although the region enjoys a generally comfortable standard of living, its countries differ significantly when you look at their individual resource bases, geographical sizes, populations, and long-term economic conditions. These contrasts help explain why some states have become major global players while others remain developing economies.

Despite the geographic closeness of MENA states, economic cooperation within the region remains relatively limited. Cross-border interaction tends to revolve more around labor mobility than the exchange of goods and services. Many citizens migrate to wealthier Gulf nations for employment, yet trade flows remain narrow compared to other world regions that have more integrated economic blocs. This uneven pattern of interaction continues to shape how businesses operate and how countries respond to regional challenges.

Population and Geographic Characteristics

Spanning more than 15 million square kilometers, the MENA region covers an impressive slice of the world’s landmass. It is home to about six percent of the global population—a figure comparable to the entire population of the European Union. The demographic landscape is varied: the smallest countries, such as Bahrain, Djibouti, and Qatar, each have roughly half a million residents, while the two largest nations—Egypt and the Islamic Republic of Iran—each exceed 60 million people. When combined with Algeria, Morocco, and Sudan, these five populous states represent around 70 percent of the region’s total population.

Urbanization is also a defining characteristic, with nearly half of the population living in cities. These urban centers serve as hubs for industry, education, and cultural exchange. The population distribution highlights the regional complexity: small, resource-rich countries often rely on foreign labor, while the more populous nations carry larger social and economic responsibilities.

Demographic Trends and Growth Patterns

Most countries within MENA are undergoing rapid population expansion. High dependency ratios—where a large portion of the population is young or elderly—pose challenges for economic planning. Between 1989 and 1994, the average annual population growth rate in the region was approximately three percent, mirroring that of sub-Saharan Africa.

A major driver behind this expansion is the persistently high fertility rate in many states, especially when compared with countries of similar per capita income. Nations such as Kuwait, Libya, Oman, Qatar, Saudi Arabia, and the United Arab Emirates have experienced population growth rates surpassing 3.5 percent in recent years. In contrast, Bahrain, Iran, Lebanon, and Tunisia reported growth rates lower than the two-percent average observed across developing economies. These differences influence everything from infrastructure needs to social services, education systems, and long-term economic planning.

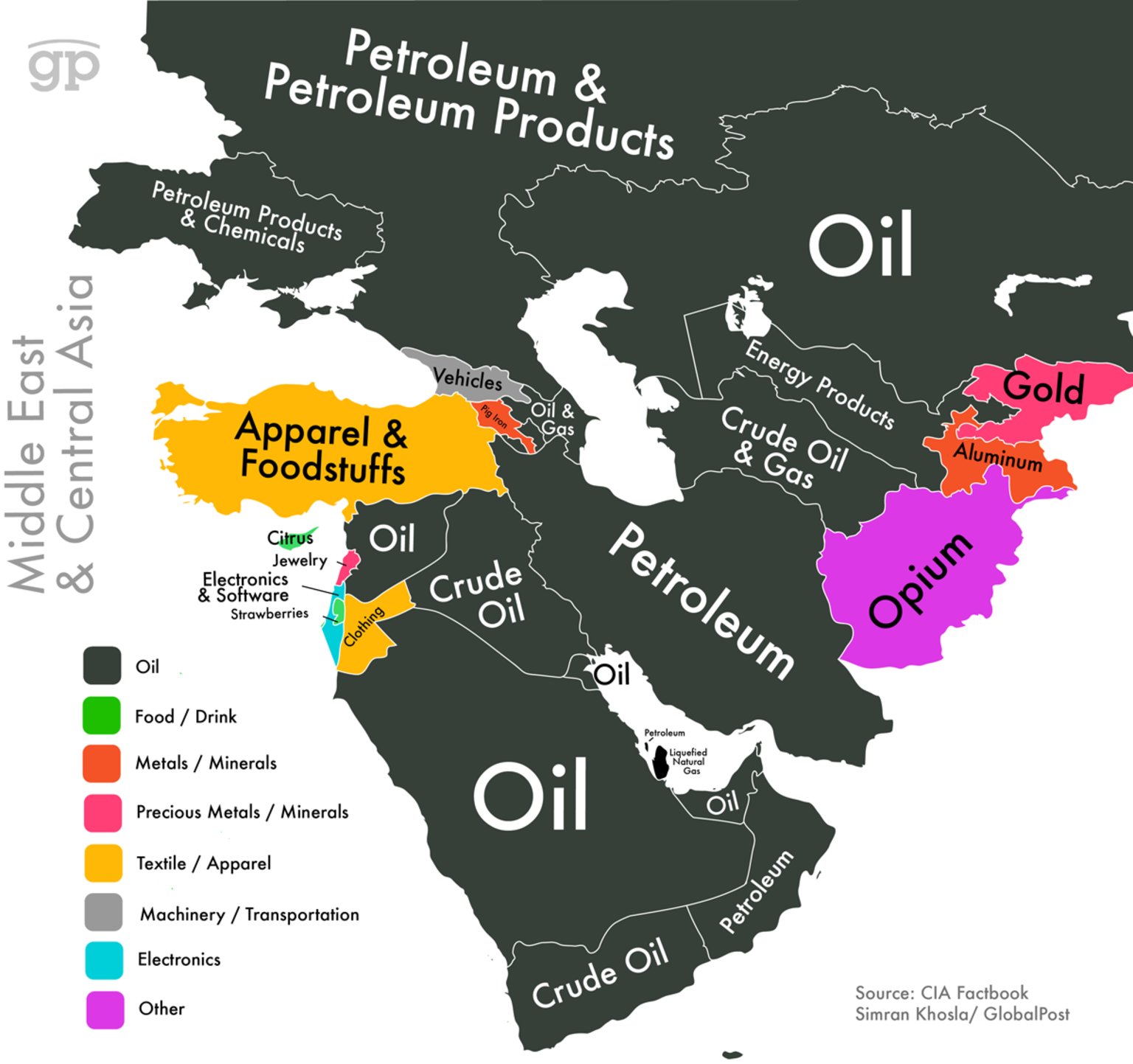

Ranking the Top Economies by GDP

Using the World Bank’s 2014 economic data, the following section examines the top ten economies in the MENA region by Gross Domestic Product (GDP). Each country’s position reflects not only its natural resources, industrial capacity, and global ties but also the challenges and opportunities shaping its growth.

10 – Morocco ($104,374,000,000)

Morocco has managed to achieve stable economic growth over the past several years, maintaining an average rate of around five percent despite external pressures such as fluctuations in global markets and uncertainties tied to the Eurozone crisis. Ranked 61st globally, Morocco’s economy is supported by several major sectors: agriculture remains central, tourism attracts millions of visitors annually, and textiles and mining—particularly phosphate extraction—play essential roles. The country’s ability to navigate global volatility while strengthening key industries demonstrates a relatively resilient economic model.

9 – Kuwait ($183,219,000,000)

Kuwait holds approximately ten percent of the world’s proven oil reserves, making petroleum the foundation of its economy. The energy sector dominates national revenues, but Kuwait also benefits from a strong fertilizer industry and one of the world’s most highly valued currencies, the Kuwaiti dinar. Standing at 54th place globally in GDP rankings, the country is home to major institutions like the National Bank of Kuwait, which remains one of the region’s leading financial players. Despite its dependence on oil, Kuwait continues exploring broader diversification strategies to ensure long-term economic stability.

8 – Qatar ($202,450,000,000)

Petroleum remains the backbone of Qatar’s national economy, accounting for more than 70 percent of government income, over 60 percent of total GDP, and approximately 85 percent of export earnings. The country’s rapid development has been fueled by its immense natural gas reserves and the surge in infrastructure projects—particularly those connected to hosting the 2022 FIFA World Cup. Massive investments in construction, tourism, and international partnerships continue to shape Qatar’s economic landscape. Globally, Qatar ranks 50th in GDP, reflecting both its wealth and its strategic efforts to diversify beyond hydrocarbons.

7 – Algeria ($210,183,000,000)

Algeria ranks just ahead of Qatar and holds the 49th position globally in GDP. Although oil and natural gas collectively form a major pillar of its revenue, the Algerian economy is more diversified than many assume. Agriculture stands as the nation’s largest employer, supporting millions of residents and contributing significantly to domestic food production. Meanwhile, industries such as steel manufacturing, mechanical and electrical goods, and various forms of light industry provide crucial economic support.

Economic forecasts in recent years have projected growth of roughly four percent, driven by government investment programs and improved energy sector performance. Algeria’s mix of natural wealth, industrial capacity, and a growing consumer market places it in a unique position within the wider MENA economic structure.

6 – Iraq ($222,879,000,000)

Despite decades of intense political disruption and instability, Iraq remains the 46th largest economy in the world—a testament to the scale of its natural resources and economic potential. Oil dominates the country’s exports and provides the bulk of government funding, yet several non-oil sectors continue to play important roles. Textiles, food processing, construction materials, pharmaceuticals, and chemicals all contribute to domestic production.

Part of Iraq’s ongoing challenge lies in the structure of its public finances. Many essential sectors—including healthcare, education, and infrastructure—depend heavily on government spending, which in turn relies on oil revenues. This makes long-term stability difficult, but it also means that any economic diversification could unlock significant new opportunities for growth across the country.

5 – Egypt ($271,973,000,000)

Egypt holds the 41st position globally in GDP and remains one of the region’s most influential economies due to its size, geographic importance, and diverse production base. Agriculture and textiles form the backbone of its traditional industries, but tourism, construction, telecommunications, and financial services also contribute meaningfully.

In recent years, political changes and social unrest have placed the economy in a state of transition. To support Egypt through its adjustment period, Gulf countries—particularly Saudi Arabia, the UAE, and Kuwait—offered generous financial aid packages. In 2013, these nations collectively pledged around $17 billion to stabilize Egypt’s economic environment and help maintain essential services. As reforms advance, Egypt aims to strengthen its industrial capabilities and expand employment opportunities.

4 – Israel ($291,357,000,000)

Israel’s economy stands out in the MENA region because it is less dependent on natural resources and more driven by technology, innovation, and scientific research. Although the country lacks major oil or mineral reserves, it has developed world-leading industries in high-tech equipment, electronic systems, pharmaceuticals, aerospace technology, and advanced manufacturing.

The Israeli diamond sector is one of the most important diamond-cutting and polishing centers globally, further diversifying economic activity. With a global GDP ranking of 37th, Israel’s strong emphasis on knowledge-based industries continues to shape its international competitiveness.

3 – Iran ($368,904,000,000)

Iran’s economy—ranked 32nd in the world—is one of the largest and most complex in the Middle East. While oil and natural gas remain its most prominent industries, the country has built a broad economic foundation with more than 40 other sectors represented on its national stock exchange. Key industries include pharmaceuticals, automotive manufacturing, telecommunications, mining, steel, and construction.

Interestingly, Iran was shielded from some of the worst effects of the 2008 global financial crisis due to its relative economic isolation at the time. Its centrally planned elements still play a major role in shaping production and investment patterns, but ongoing diversification efforts have added depth to the workforce and increased local industrial capacity.

2 – United Arab Emirates ($383,799,000,000)

The UAE, ranked 30th globally, has undergone one of the most dramatic economic transformations in the modern era. Since gaining independence in 1971, the country’s economy has expanded more than 230 times. Although petroleum remains significant, more than 70 percent of its current revenues come from non-oil sectors.

Key industries include aluminum production, fishing, real estate, logistics, tourism, and construction materials. Major cities such as Dubai and Abu Dhabi have become global centers for finance, aviation, luxury tourism, and international trade. The UAE’s commitment to long-term diversification continues to attract foreign investment and highly skilled workers from around the world.

1 – Saudi Arabia ($745,273,000,000)

Saudi Arabia stands as the largest economy in the MENA region and ranks 19th globally. Its economic strength is overwhelmingly tied to its extraordinary natural resource base. The Kingdom holds around one-fifth of the world’s known petroleum reserves, and the oil sector dominates every layer of national revenue. More than 75 percent of government income comes from oil, and over 95 percent of the country’s produced oil is managed and sold by the state-owned giant, Saudi Aramco—one of the most valuable companies on the planet.

Yet, Saudi Arabia’s economic activity stretches beyond oil. Several other industries contribute meaningfully to the country's overall productivity. These include manufacturing sectors such as cement, plastics, fertilizers, and metals, alongside industrial repair services that support commercial ships and aircraft. Large-scale construction projects fuel job creation and infrastructure development, reflecting the country’s long-term vision for economic modernization.

Saudi Arabia maintains strong trading relationships with major economic partners. Its principal export destinations include China, the United States, Singapore, South Korea, India, and Japan. These partnerships not only solidify the Kingdom’s global economic relevance but also help ensure stable demand for its resources and manufactured goods.

The private sector accounts for roughly 40 percent of national GDP, with foreign workers playing a crucial role across nearly every industry—from healthcare and engineering to construction and finance. Over the past years, the government has accelerated investment in education, job training programs, transportation networks, urban development, and public institutions. These efforts aim to cultivate a more diversified economy capable of supporting long-term growth.

Despite its rapid development, the country remains governed by an absolute monarchy. This centralized political structure influences policy direction, economic reforms, and the overall pace of national transformation. Saudi Arabia’s steady investment in both human capital and infrastructure underscores its goal of maintaining its position as the leading economy in the Middle East for decades to come.

Updated Snapshot: Projected Top 10 MENA Economies in 2026

Although the original rankings in this article are based on 2014 World Bank GDP data, the economic landscape of the MENA region has shifted considerably over the past decade. Many countries have expanded, diversified, or restructured their economies—especially Gulf states investing heavily beyond oil.

Using the latest IMF 2024–2025 nominal GDP figures and extending those trends toward 2026, below is an updated projected list of the largest economies in the MENA region for 2026.

(Note: These figures are projections based on the most recent IMF database and may shift as new data is released.)

Projected 2026 MENA GDP Ranking (Nominal GDP)

| Rank | Country | Estimated 2026 GDP (USD) | Notes |

|---|---|---|---|

| 1 | Saudi Arabia | ~$1.05 trillion | Continues as the region’s largest due to oil, diversification plans, and investment. |

| 2 | United Arab Emirates | ~$590–620 billion | Rapid non-oil growth, strong tourism, finance, aviation. |

| 3 | Egypt | ~$475–510 billion | Large population, mixed economy; FX pressures remain, but GDP size stays high. |

| 4 | Israel | ~$540–560 billion | High-tech powerhouse, strong services sector. |

| 5 | Iran | ~$400–420 billion | Growth constrained by sanctions but remains structurally large. |

| 6 | Qatar | ~$240–255 billion | LNG expansion keeps Qatar in the top tier. |

| 7 | Algeria | ~$190–205 billion | Hydrocarbons + agriculture + manufacturing. |

| 8 | Morocco | ~$150–160 billion | Stable growth, strong agriculture, automotive, renewable energy. |

| 9 | Iraq | ~$180–195 billion | Oil-heavy economy; growth depends heavily on global oil markets. |

| 10 | Kuwait | ~$150–170 billion | Oil-driven economy; slow diversification keeps GDP relatively stable. |

Interpretation of the 2026 Ranking

-

Saudi Arabia remains the undisputed regional leader, driven by oil revenues and massive economic diversification under Vision 2030.

-

The UAE has accelerated past many others, powered by tourism, finance, renewable energy, and trade.

-

Egypt remains high due to its population size, even though economic challenges affect per-capita income.

-

Israel’s tech sector pushes it into the upper tier of all MENA economies.

-

Qatar, Algeria, and Iraq shift places depending on global oil prices each year.

-

Morocco shows stable and consistent growth, becoming one of North Africa’s steadiest performers.

-

Kuwait completes the top 10, maintaining significant wealth despite slower diversification.